How to prepare for an audit of your financial statements?

Through preparation and correspondence, you can make your yearly audit be an effortless procedure that does what it's proposed to do: help financial guarantee statements are exact and your financial revealing frameworks are sound. The following are a couple of tips to help kick you off:

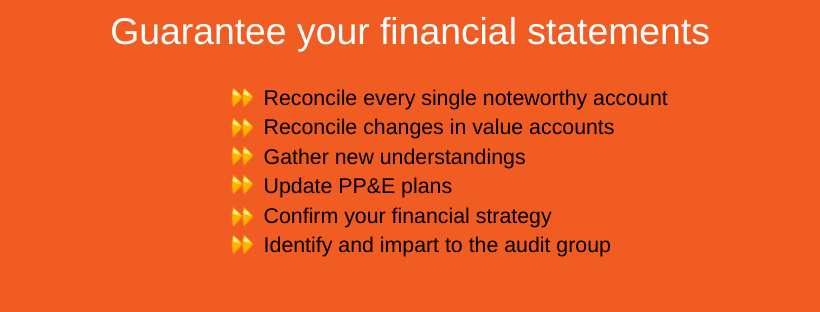

1. Reconcile every single noteworthy account including yet not constrained to financial, records of sales, stock, creditor liabilities, and accumulated costs. This is by a wide margin the most significant advance that you can take to get ready for your financial summary audit. Most alterations that are found during audit hands-on work identify with compromises not being ready. Moreover, it is basic to guarantee you have support for any noteworthy accommodating things.

1. Reconcile every single noteworthy account including yet not constrained to financial, records of sales, stock, creditor liabilities, and accumulated costs. This is by a wide margin the most significant advance that you can take to get ready for your financial summary audit. Most alterations that are found during audit hands-on work identify with compromises not being ready. Moreover, it is basic to guarantee you have support for any noteworthy accommodating things.2. Reconcile changes in value accounts including new value understandings as well as alterations to existing understandings. This compromise will guarantee that all progressions inside the value accounts during the financial year are appropriately represented and displayed fittingly inside the financial reports.

3. Gather new understandings or potentially corrections to existing understandings went into during the year including working understandings, rent understandings, obligation understandings, and so on. These understandings will be audited by your auditor during hands-on work audit systems and will be used to set up the commentaries to your financial reports.

4. Update PP&E plans – Even on the off chance that your bookkeeper computes your deterioration, gathering a rundown of advantages you've acquired and sold through the span of the year will facilitate the procedure. Be certain your PP&E synopsisdates, sums, and definite depictions of all advantages obtained and sold during the financial year.

5. Confirm your strategic financial management is being pursued and is in consistence with the new IRS guidelines.

6. Gather and arrange a detail of all related gathering exchanges including deals, buy, leases, and so forth. These exchanges will be assessed by your auditor during hands-on work audit firms in Dubai strategies and will be used to set up any fundamental references inside your financial reports.

7. Identify and impart to the audit group every noteworthy change in business tasks and additionally changes in bookkeeping strategy from the past year audit (if relevant). If you can proactively address any such changes in front of the time, it will help guarantee the audit go easily. Moreover, if during the year you go into a significant exchange (buy a business, acquire new obligation, sign another rent, change bookkeeping rule, receive new bookkeeping declarations, and so forth.) impart such changes to your auditor forthright; proactively working through an exchange after it happens takes into account month to month answering to be right.

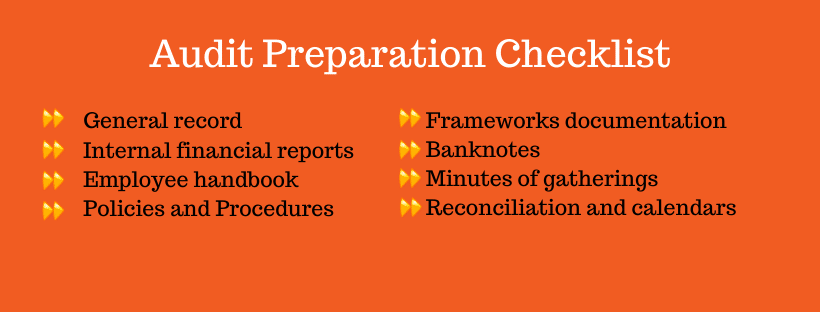

8. Prepare the entirety of the things on the auditor's readiness agenda preceding the start of hands-on work. Coming up next is a general rundown of things most often required by auditors regarding the audit of financial statements for little to medium estimated organizations. The data ought to be submitted electronically, in Excel design, if conceivable. Your auditor may likewise demand different things, contingent upon the business in which you work.

Audit Preparation Checklist

- General record (additionally called a working preliminary parity) covering the whole budgetary year.

- Internal financial reports.

- Articles of Incorporation and Bylaws (or other association documentation).

- Equity authentications.

- Employee handbook policies.

- Accounting Policies and Procedures manual.

- Organization diagrams and frameworks documentation (notices enumerating stream of exchanges inside the organization).

- Banknotes, security understandings, and rent understandings.

- Minutes of gatherings of the Board of Directors and some other oversight advisory groups.

- Financial year spending plan.

- Your auditor will require access to every took care of tab and checks got during the year.

- Reconciliation and calendars supporting all benefits, obligations, and value accounts.

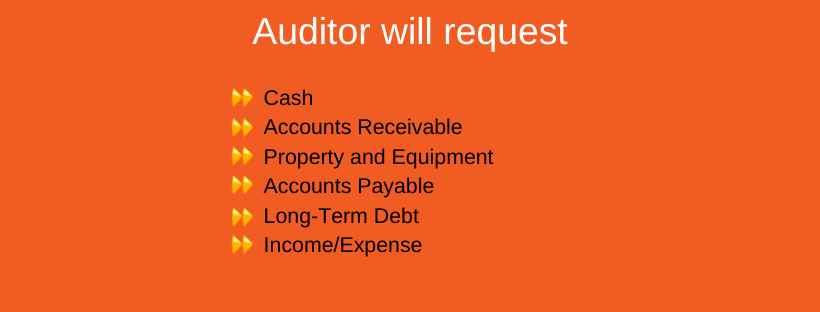

Coming up next are the most well-known things that auditor will request:

Cash

Cash

- Year-end bank compromise and bank proclamations. Bank compromise ought to have a total rundown of remarkable checks with check number, date, and sum. Detail of stores in travel ought to likewise be recorded.

- Your auditor will give standard structures and request that you get ready affirmations, which the reviewers will mail to the bank.

- Your auditor will request that you give the month to month bank articulations got from the bank for the financial year and the principal month following the finish of the budgetary year.

Accounts Receivable

- Detailed matured posting of all records receivable adjusts by receipt as of the year's end (accommodated to the G/L). Your auditor will normally choose clients and request that you get ready affirmations, which the auditors will mail to the client.

- Your auditor will probably solicit you to set up an investigation from the collectability of matured record adjusts.

- Inventory

- Detailed stock reports as of the year's end (accommodated to the general record), including overhead figuring, if material.

- Your auditor will regularly watch your year-end stock check to confirm the presence of stock at year-end and for any out of date quality issues.

Property and Equipment

- Fixed resource move forward timetable indicating starting parity in every benefit class in addition to augmentations, less transfers approaches finishing balance accommodated to the general record.

- Detail of fixed resource increments and transfers during the year.

- Book deterioration plan by resource including valuable lives, devaluation strategy, and so on

Accounts Payable

- Accounts payable matured preliminary equalization as of the finish of the financial-related year.

- Check registers for the period between year-end and the date of hands-on work.

Long-Term Debt

- Debt move forward calendar indicating starting equalization in each note in addition to borrowings, less reimbursements approaches finishing note balance accommodated to the general record.

- Schedule of future developments of long haul obligation for the following five years accommodated to the terms of obligation understandings.

- Compliance plans for pledges.

Income/Expense

- Monthly income and cost auditor and gross benefit pattern investigation.

- Variance auditor spreadsheet for general and regulatory costs.

- Schedule of lease cost accommodated to the particulars of the rent understandings and timetable of future least rent installments throughout the following five years.

- Access to all manual diary passages made during the year.

- Details of fixes and upkeep account.

- Detail of legitimate expenses paid, with the name and address of all lawyers utilized consistently.

Financial statement audits can be an overwhelming and distressing procedure, be that as it may, with a satisfactory measure of arrangement and correspondence between the Company and the evaluator, the procedure can be moderately easy for all included. Being appropriately arranged for a Financial statement audits can spare you time and financial related over the long haul.

Related Posts

Accounting Firms In Dubai

How to get an audited financial statement

Internal audit preparation checklist

0 Comments