How To Maximize Their Success On An Audit

10 Steps to a Successful Audit

On the off chance how to maximize their success on an auditing planning for your forthcoming audit appears to be overwhelming, you're not the only one. A considerable lot of us feel a feeling of fear at financial year-end. We've assembled best tips to assist you with having a smooth audit:

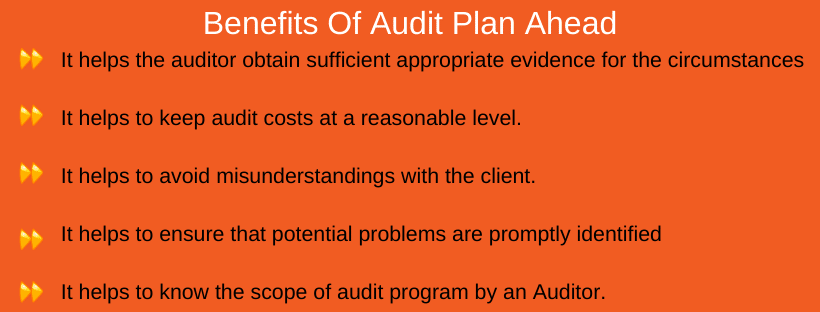

1. Plan ahead

Dedicate extra time both before and regarding year-end near enough plan for how to maximize their success on an audit, to be accessible during audit hands-on work, and to speak with those associated with the audit procedure. Legitimate arranging and clear desires will help limit nervousness and dissatisfaction. To be on top of things, treat audit readiness as a year-long procedure.

Dedicate extra time both before and regarding year-end near enough plan for how to maximize their success on an audit, to be accessible during audit hands-on work, and to speak with those associated with the audit procedure. Legitimate arranging and clear desires will help limit nervousness and dissatisfaction. To be on top of things, treat audit readiness as a year-long procedure.By staying up with the latest consistently, you can diminish the time it takes to get ready for the audit toward the year's end. Additionally, keep up an open line of correspondence between the association and the external audit firms in Dubai during the year as opposed to holding up until the audit to examine new or uncommon exchanges. This will limit amazes and enable the association to make proper arrangements or important changes.

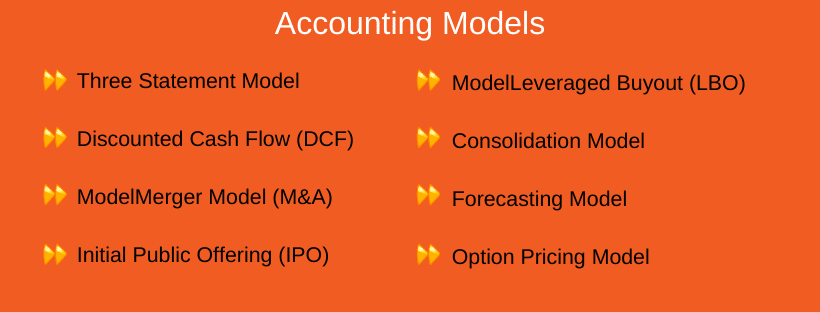

2. Keep awake-to-date on accounting models.

New accounting professions may influence your association's audit. You will need to keep awake to-date since you may need to oversee or follow information in an alternate way (for instance, by refreshing documentation or revamping the graph of records) to execute new models. Likewise, make certain to evaluate in the case of accounting for the workforce require any extra preparing or data to execute the new necessities. The AICPA gives news alerts to its individuals on new and developing patterns influencing NFPs through its Not-revenue driven Section and furthermore distributes the yearly Not-revenue driven Entities - Audit and Accounting Guide. To go directly to the source, alluding to the Financial Accounting Standards Board's site, fasb.org, to figure out which new accounting firms in Dubai declarations are compelling for the year under audit.

New accounting professions may influence your association's audit. You will need to keep awake to-date since you may need to oversee or follow information in an alternate way (for instance, by refreshing documentation or revamping the graph of records) to execute new models. Likewise, make certain to evaluate in the case of accounting for the workforce require any extra preparing or data to execute the new necessities. The AICPA gives news alerts to its individuals on new and developing patterns influencing NFPs through its Not-revenue driven Section and furthermore distributes the yearly Not-revenue driven Entities - Audit and Accounting Guide. To go directly to the source, alluding to the Financial Accounting Standards Board's site, fasb.org, to figure out which new accounting firms in Dubai declarations are compelling for the year under audit.3. Survey changes in exercises.

Did the association start another program or get another award? Are there any new announcing prerequisites? Were any exercises stopped, or were there any weaknesses? Were there huge changes in inside control framework? Such changes in exercises may trigger accounting and detailing contemplations that ought to be imparted to the auditor during the arranging audit procedure.

4. Gain from an earlier time.

Check out any earlier year audit modifications, inside control suggestions, or battles experienced during earlier audits. How to maximize their success on an audit can be a beginning stage for self-audit and a memory-jogger to guarantee these issues are not rehashed. During the arranging meeting with the inspectors, audit what went well during a year ago's audit and where there might be open doors for development or increasingly successful correspondence between the association and the evaluators.

5. Create a course of events and relegate obligation.

Survey the rundown of work papers and calendars mentioned by the auditor, making a point to get the explanation of the mentioned data when vital. Allot everything from the rundown to a capable individual and incorporate a due date. Make a point to permit sufficient time for audit and revision of timetables if essential. Handle the most troublesome, complex, or tedious regions first whenever the situation allows. The drafts of the reports, calendars, wallpapers or different things mentioned by the auditor ought to be accessible at the very latest the main day of audit hands-on work.

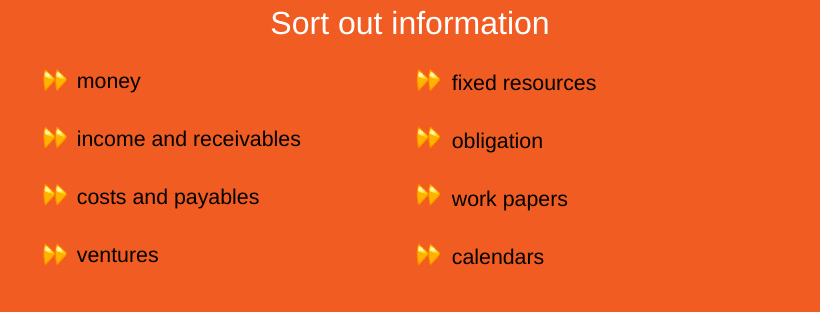

6. Sort out information.

Make a storehouse of audit plans that can be gotten to in future years by the proper faculty. Consider making subfolders for critical exchange cycles or classifications, for example, money, income and receivables, costs and payables, ventures, fixed resources, obligation, and so forth to make it simpler to oversee and recover plans. Calendars and work papers containing touchy data, for example, finance, maybe secret key ensured or kept up in a suitably limited system area.

Make a storehouse of audit plans that can be gotten to in future years by the proper faculty. Consider making subfolders for critical exchange cycles or classifications, for example, money, income and receivables, costs and payables, ventures, fixed resources, obligation, and so forth to make it simpler to oversee and recover plans. Calendars and work papers containing touchy data, for example, finance, maybe secret key ensured or kept up in a suitably limited system area.7. Posture inquiries.

On the off chance that a thing mentioned by the auditor is vague, request explanation preceding the beginning of hands-on work to stay away from potential postponements. Evaluators are commonly glad to address accounting questions concerning irregular or rare exchanges the association may require help with representing. Additionally, pose inquiries of those inside the association to get data important to plan required reference divulgences. Such exchanges could incorporate noteworthy accounting gauges, pending or compromised case, related party exchanges, responsibilities and possibilities, and different points important to get ready required reference revelations.

8. Play out a self-audit.

When all year-end shutting passages are made, audit timetables and work papers to guarantee sums concur or accommodate to the preliminary equalization. Make a stride back and survey the general financial reports for sensibility. Likewise, peruse and update the notes to your financial reports, and allude to a divulgence agenda to ensure you have incorporated all the necessary data. Beset up to clarify financial report detail changes from year to year or spending plan to real.

9. Be accessible during hands-on work.

Maintain a strategic distance from key faculty booking a break during the audit, and consider rescheduling or delaying non-basic gatherings for money and accounting staff intensely engaged with the audit. Albeit the vast majority of the timetables and work papers will have been mentioned by the evaluators before the beginning of audit hands-on work, comprehend that the auditors will request extra data, including supporting archives and clarifications, all through hands-on work. Consider having brief status gatherings or acquiring an open things list from the evaluators at sensible interims during the commitment to follow progress.

10. Assess results.

Keep up correspondence with the evaluators during the time among hands-on work and the issuance of the audit report. If there are any open things toward the finish of hands-on work, set up settled upon dates for the data to be given to the auditor at whatever point conceivable. If the inspector is to go to gatherings with the audit or money advisory group as well as top managerial staff, affirm that the auditor has the date, time, meeting area and other relevant subtleties of the gathering. Consider holding a post-audit shutting meeting with representatives engaged with the audit to impart results and request input.

Related Posts

Documents Required For Audit Of The Company

Business Valuation Services Providers

Dubai Internet City

0 Comments