IFRS 16 sublease accounting

IFRS 16 sublease accounting entries is the same old thing for lessors, yet makes intricacy in subleasing courses of action. In the May 2018 version of Accounting Alert we noticed that IFRS 16 Leases ("IFRS 16"), which becomes effective for financial detailing periods starting on or after 1 January 2019, will in a general sense change the way wherein lessees record for leases.

IFRS 16 Sublease Accounting enquires call @ +971 45 570 204 / Email Us : support@kgrnaudit.com

Accounting by lessors under IFRS 16

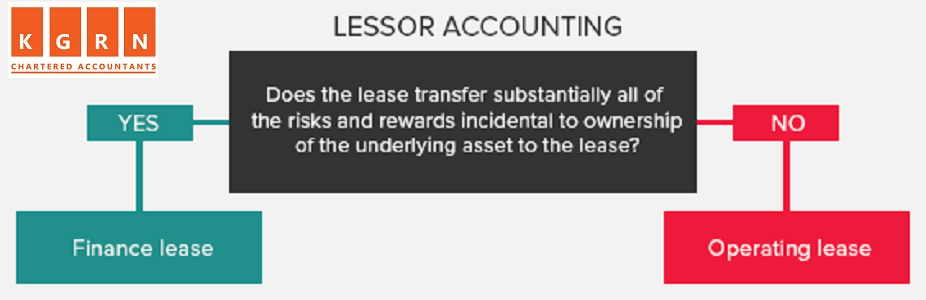

The selection of IFRS 16 sublease accounting by lessors, be that as it may, won't be unpredictable, as IFRS 16 holds the IAS 17 Leases accounting treatment for lessors.

This implies IFRS 16 requires a lease:

This implies IFRS 16 requires a lease:- To be classified an IFRS 16 sublease accounting finance lease if considerably the entirety of the risks and prizes coincidental to responsibility for the leased resource has been moved to the resident

- To generally be classified as an operating lease.

Regardless of whether an IFRS 16 sublease accounting is a finance leases or an operating lease relies upon the substance of the exchange, as opposed to the type of the agreement. Therefore, characterization can require the use of impressive expert judgment.

To help with that judgment, IFRS 16 sublease accounting entries give instances of circumstances that independently or in the blend would typically prompt a lease being classified an accounting lease:

Circumstances that would regularly prompt a lease being classified an IFRS 16 finance lease:

The IFRS 16 sublease accounting moves responsibility for basic advantage for the resident before the finish of the lease term

The lease has the choice to buy the basic resource at a value that is relied upon to be adequately lower than the reasonable incentive at the date the choice gets exercisable for it to be sensibly sure, at the origin date that the alternative will be worked out

The IFRS 16 sublease accounting entries term is for the significant piece of the financial existence of the hidden resource regardless of whether a title isn't moved

At the initiation date, the present estimation of the IFRS 16 sublease accounting installments adds up to in any event considerably the entirety of the reasonable estimation of the hidden resource

The basic resource is of such a particular nature, that lone the lease can utilize it without significant adjustments

IFRS 16 sublease accounting likewise gives pointers of circumstances that exclusively or in the mix could prompt a lease being classified a finance lease:

Circumstances that could prompt a lease being classified an IFRS 16 accounting lease:

On the off chance that the tenant can drop the lease, the lessor's misfortunes related with the crossing out are borne by the resident

Additions or misfortunes from the change in the reasonable estimation of the lingering accumulate to the lease (for instance, as a lease discount equaling the majority of the business continues toward the finish of the lease)

The resident can proceed with the lease for an auxiliary period at a lease that is considerably lower than advertise lease

IFRS 16 sublease accounting characterization is made at the original date of a lease and is reassessed just if there is a lease adjustment. Changes in gauges (for instance, changes in evaluations of the financial life, or of the leftover estimation of the hidden resource), or changes in conditions (for instance, default by the lease), don't offer ascent to another characterization of a lease for accounting purposes.

IFRS 16 Sublease Accounting enquires call @ +971 45 570 204 / Email Us : support@kgrnaudit.com

Lessor representing accounting leases

Under IFRS 16, lessors represent accounting leases by at first derecognizing the advantage and perceiving a receivable for the net interest in the lease.

Beginning direct costs (other than those caused by a maker or seller lessor) are remembered for the net interest in the lease.

The IFRS 16 sublease accounting installments remembered for the estimation of the net interest in the lease contain the accompanying installments for the privilege to utilize the basic resource during the lease term that is not gotten at the initiation date:

• Fixed installments, less any lease motivating forces payable

• Variable lease installments that rely upon a file or a rate, at first estimated utilizing the list/rate at the initiation date

• Any lingering esteem ensures gave to the lessor by the resident, a related gathering of the tenant, or difference gatherings irrelevant to the lessor that are monetarily fit for releasing the commitments under the assurance

• The practice cost of a buy alternative if the lease is sensibly sure to practice that choice

• Payments of punishments for ending the lease, if the lease term mirrors the resident practicing a choice to end the lease.

The lessor must utilize the loan fee verifiable in the IFRS 16 sublease accounting to gauge the net interest in the lease.

Ensuing to introductory acknowledgment, a IFRS 16 lessor must perceive finance salary over the lease term, given an example mirroring a steady intermittent pace of profit for the lessor's net interest in the lease (for example it must utilize the amortized cost technique).

The new weakness prerequisites for finance-related resources remembered for IFRS 9 Financial Instruments must be applied to the lease receivable.

Lessor representing operating leases

Under IFRS 16, a lessor in an operating leaseholds the lease resource on its books, and perceives salary got (net of lease motivators gave to the lease) on a straight-line premise over the term of the lease (except if another precise premise is increasingly illustrative of the example in which profit by the utilization of the hidden resource is decreased, in which case lease pay got is perceived on that premise).

The lessor should likewise:

• Recognize costs brought about in procuring the lease payments as a cost

• Depreciate the advantage in a way that is steady with the lessor's typical devaluation arrangement for comparable resources

• Assess the leased resource for debilitation under IAS 36 Impairment of Assets

• Add beginning direct expenses acquired in getting the lease to the conveying measure of the leased resource and perceive those expenses as a cost over the lease term on a similar premise as the lease payments.

IFRS 16 Sublease Accounting enquires call @ +971 45 570 204 / Email Us : support@kgrnaudit.com

IFRS 16 Subleasing

While the IFRS 16 sublease accounting for representing leases as illustrated above are the same old thing for lessors, they are progressively mind-boggling when applied by a lessor in a sublease course of action.

IFRS 16 requires a middle lessor to order the sublease as a finance lease or an operating lease as pursues:

• If the head lease is a transient lease that the substance, as a tenant, has represented by perceiving the lease installments as a cost on a straight-line premise over the term of the lease, the sublease must be classified an operating lease

• Otherwise, the sublease must be characterized by reference to one side of-utilization resource emerging from the head lease, as opposed to by reference to the monetary helpful existence of the hidden resource, (for example, the thing of property, plant or hardware that is the subject of the lease).

Thusly, where the head lease is anything but a transient lease expensed on a straight line premise over the lease term, the lessor must utilize the general standards (and the related models and pointers) for order of a lease as an operating or a finance lease (as sketched out above) by reference to one side of-utilization resource.

- Arrangement of IFRS 16 subleases

- Representing IFRS 16 sublease

At the point when the middle of the road lessor goes into the sublease:

• It holds the lease risk and the right-of-utilization resource identifying with the head lease in its announcement of the finance-related position

At the point when the halfway lessor goes into the IFRS 16 sublease it:

• Derecognizes the right-of-utilization resource identifying with the head lease that it moves to the sub-lease, and perceives the net interest in the sublease

• Recognizes any contrast between the right-of-utilization resource and the net interest in the sublease in benefit or deficit

• Retains the lease risk identifying with the head lease in its announcement of finance-related position, which speaks to the lease installments owed to the head lessor.

During the term of the IFRS 16 sublease, the moderate lessor:

• IFRS 16 sublease accounting Recognizes a deterioration charge for the right-of-utilization resource and enthusiasm on the lease obligation

• Recognizes lease payments from the sublease. During the term of the sublease, the middle of the road lessor perceives:

• Finance pay on the sublease

• Interest cost on the head lease.

IFRS 16 Sublease Accounting enquires call @ +971 45 570 204 / Email Us : support@kgrnaudit.com

Related Services: Audit Services in Dubai, Accounting Services in Dubai, ESR Filing Services

Frequently Asked Questions

What is a lease under IFRS 16?

Since accounting leases under IFRS 16 outcomes in generously all leases being perceived on a lessee’s accounting report, the assessment of whether an agreement is (or contains) a lease turns out to be significantly more significant than it is under IAS 17 and IFRIC 4. Practically speaking, the primary effect will be on gets that are not in the authoritative document of a lease however include the utilization of a particular resource and subsequently may contain a lease –, for example, redistributing, contract assembling, transportation and force supply understandings. Right now, this assessment depends on IFRIC 4; in any case, IFRS 16 replaces IFRIC 4 with new direction that contrasts in some significant regards.

How do you account for lease under IFRS 16?

The standard gives a solitary lessee accounting model, expecting lessees to perceive resources and liabilities for all leases except if the lease term is a year or less or the hidden resource has a low worth. Lessors keep on characterizing leases as working or fund, with IFRS 16’s way to deal with lessor accounting considerably unaltered from its ancestor, IAS 17.

What is the purpose of IFRS 16?

The target of IFRS 16 is to report data that (a) reliably speaks to lease exchanges and (b) gives a premise to clients of financial summaries to survey the sum, timing and vulnerability of incomes emerging from leases.

What does IFRS 16 replace?

IFRS 16 (International Financial Reporting Standard) is another standard for lease accounting which will come into power in January 2019. It will supplant the current IAS 17 lease accounting standard.

Does IFRS 16 apply to property leases?

The IASB has given another leases standard that expects Tenants to perceive most tenant agreements on their asset reports. Tenants will apply a solitary accounting model for every single tenant agreement (with an exception for transient leases).Landowner accounting is generously unaltered and the IAS 17 characterization guideline has been continued to IFRS 16.Tenants that measure venture property at reasonable worth will likewise quantify leaseed speculation property at reasonable worth.

2 Comments

Ne'er knew this, regards for letting me know.

ReplyDeletehttp://fcialisj.com/ - cheap cialis online

ReplyDelete