IFRS 16 Leases an insight

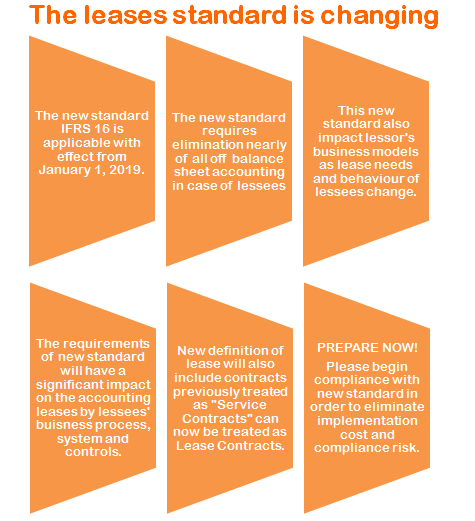

The leases standard is changing the new standard IFRS 16 leases an insight is applicable with effect from January 1, 2019. The requirements of the new standard will have a significant impact on the accounting leases by lessees’ business processes, systems, and controls. The new standard requires elimination nearly of all off-balance sheets accounting in case of lessees.

The leases standard is changing the new standard IFRS 16 leases an insight is applicable with effect from January 1, 2019. The requirements of the new standard will have a significant impact on the accounting leases by lessees’ business processes, systems, and controls. The new standard requires elimination nearly of all off-balance sheets accounting in case of lessees.A new definition of IFRS 16 leases an insight will also include contracts previously treated as “Service Contracts” can now be treated as Lease Contracts. This new IFRS 16 standard also impacts lessor’s business models as lease needs and behavior of lessees change.

IFRS 16 Leases an insight enquiries call @ +971 45 570 204 / Email Us : support@kgrnaudit.com

Prepare now for IFRS 16 leases an insight

Please begin compliance with the KGRN new IFRS 16 leases an insight standard to eliminate implementation cost and compliance risk.

The Impact

The Impact

The new standard was issued by IASB in January 2016 with an effective date from January 1, 2019. It requires recognition of nearly all the leases on the financial statements which will disclose their right to use an asset for a period of time and related IFRS 16 leases an insight liability for payments.

Leasing is an alternative approach for the Entities in the nature of financing solution, as it allows using property or equipment without owning it, which results in savings of huge cash outflows at the inception.

The risk of obsolescence and residual value will be eliminated allowing flexibility to IFRS 16 leases an insight.

IFRS 16 Leases an insight enquiries call @ +971 45 570 204 / Email Us : support@kgrnaudit.com

LESSEES

Under the old standard IAS 17, lessees accounted for lease transaction either as operating or as finance leases. However, this difference no more exists under the new practice promulgated by IFRS 16. All the lessees will have a significant impact on their statements as the reporting, asset financing, information technology, systems, and process will be undergoing substantial changes. The financial statements will undergo changes in terms of recognition of expense related to depreciation and interest expenses, increased gearing ratios.

LESSORS

IFRS 16 Lessors’ accounting firms in Dubai exercise will remain unchanged under the new standard but they may impact the business models due to changes in needs and behavior.

The new standard permits two exemptions:

1. IFRS Leases with expiry term of 12 months or less with no purchase option

2. IFRS Leases where the underlying asset has a low value.

Industries affected

Tele-communication

Transport and logistics

Retailors and Equipment lessors

IFRS 16 Leases

The effect on a new standard will be experienced across all industries, although the impacts may differ significantly. Every industry uses leasing as a means to obtain access to assets, the type and volume of assets that they IFRS 16 leases an insight, and the terms and structures of these lease agreements differ significantly.

For example, a professional services firm leases cars and corporate offices; a utility entity leases power plants; a retailer leases retail stores; a telecoms entity leases fiber optic cables; an airline leases aircraft – all with very different characteristic, terms, regulatory framework, pricing, risk, and economics. As a result, different implications may arise for different industries when adopting the new IFRS 16 standard.

IFRS 16 Leases an insight enquiries call @ +971 45 570 204 / Email Us : support@kgrnaudit.com

Understanding the discount rate

In January 2016, the International Accounting Standards Board (IASB) gave IFRS 16 leases an insight 'Renting', which speaks to the main significant update in rent representing more than 30 years. The Standard carries major changes to rent bookkeeping that supplant past bookkeeping that is viewed as never again fit for reason. These progressions become viable from 1 January 2019.

This article considers the topical region of 'Understanding the rebate rate'. Under IFRS 16 'Leases', rebate rates are required to decide the present estimation of the rent installments used to gauge a resident's rent obligation. Discount rates are additionally used to decide rent grouping for a lessor and to quantify a lessor's net interest in a rent.

IFRS 16 Leases an insight discount rate

For renters, the rent installments are required to be limited utilizing either the loan fee certain in the rent (IRIL), if that rate can be promptly decided, or the Lessee’s steady getting rate (IBR). For lessors, the discount rate will consistently be the financing cost verifiable in the rent.

The loan fee understood in the rent is characterized in IFRS 16 leases an insight as 'the pace of intrigue that causes the present estimation of (a) the rent installments and (b) the unguaranteed lingering an incentive to rise to the whole of (I) the reasonable estimation of the basic resource and (ii) any underlying direct expenses of the lessor.'

The renter's gradual getting rate is characterized in IFRS 16 as 'the pace of intrigue that a resident would need to pay to get over a comparative term, and with a comparative security, the assets important to get a benefit of a comparative incentive to one side of-utilization resource in a comparable financial condition'.

The steady getting rate is resolved on the initiation date of the rent. Thus, it will join the effect of noteworthy financial occasions and different changes in conditions emerging between rent origins and beginning.

A lessee should decide a rebate rate for all intents and purposes each rent to which it applies the renter bookkeeping model in IFRS 16. Be that as it may, a discount rate will not have to be resolved for a rent if:

A resident applies the acknowledgment exception for either a short-term or a low-esteem resource rent

All rent installments are made on (or before) the beginning date of the rent, or

All rent installments are variable and not reliant on a record or rate (egg, all rent installments differ dependent on deals or utilization).

The financing cost certain in the rent might be like the Lessee’s steady obtaining rate much of the time. The two rates consider the credit danger of the renter, the term of the rent, the security and the monetary condition wherein the exchange happens.

IFRS 16 Leases an insight enquiries call @ +971 45 570 204 / Email Us : support@kgrnaudit.com

Financing cost understood in the rent

The meaning of financing cost understood in the rent is the equivalent for both a renter and a lessor. Since it is situated to some degree upon the underlying direct expenses of the lessor, it will frequently be troublesome and much of the time inconceivable for the resident to promptly decide the loan cost certain in the rent.

For certain IFRS 16 leases an insight, including most property rents, an absence of detail data about the reasonable estimation of the fundamental resource, the normal lingering estimation of the advantage toward the finish of the rent term and any underlying direct expenses of the lessor will make it troublesome or outlandish for the renter to promptly decide the loan cost verifiable in the rent.

In different cases, the IFRS lessee might have the option to get the important data from the lessor during the rent arrangement process. The underlying reasonable estimation of the fundamental resource and remaining estimation of the basic resource may likewise be definite from a dependable outer source. The resident might have the option to sensibly discover that the lessor's underlying direct expenses would not be noteworthy to the general plan. In renting exchanges between related gatherings, almost certainly, most or the entirety of the pertinent data can be gotten by the renter.

While it is moderately basic for some customary hardware money IFRS 16 leases to make express reference to a loan cost in the rent documentation, alert is justified. This rate won't speak to the loan fee certain in the rent in the event that it does exclude a gauge of lingering an incentive for the hidden resource or consider the lessor's underlying direct expenses.

What is promptly definite?

The IFRS 16 leases an insight financing cost verifiable in the rent must be utilized just if that rate can be promptly decided. The significance of the term 'promptly definite' is available to some elucidation.

Some of the time, especially in connection to leases of land, the resident uses a valuation master to decide the loan cost verifiable in the rent. In our view, rates dictated by specialists would not qualify as promptly definable and the renter ought to utilize its gradual obtaining rate.

So also, where the loan fee verifiable in the rent must be controlled by including huge assessments and presumptions, a resident would probably reason that the financing cost certain in the rent isn't promptly definite.

The IFRS 16 effect of variable rent installments on the financing cost certain in the rent

Variable rent installments can affect the figuring of the loan fee understood in the rent. Just factor installments dependent on a file or rate ought to be remembered for the estimation of the financing cost understood in the rent (i.e. variable installments that are remembered for the meaning of rent installments). Genuine variable installments, for example, those dependent on deals or utilization, must be rejected. Shockingly, this can bring about rates that are possibly deceptive if the rent understanding is organized such that most installments are variable. On the off chance that the determined loan cost understood in the rent is negative or generally doesn't bode well, in our view the steady getting rate ought to be utilized.

Lessee’s steady acquiring rate

Where the IFRS 16 leases an insight can’t promptly decide the financing cost understood in the rent, the rebate rate will be the renter's steady obtaining rate. The gradual acquiring rate is a loan fee explicit to the lessee that reflects:

The credit danger of the lessee

The term of the rent

The nature and nature of the security

The sum 'acquired' by the lessee, and

The monetary condition (the nation, the cash and the date that the rent is gone into) in which the exchange happens.

IFRS 16 Leases an insight enquiries call @ +971 45 570 204 / Email Us : support@kgrnaudit.com

Related Posts

IFRS leases

How to pay VAT in UAE

IFRS 16 Leases In Abu Dhabi

IFRS in Dubai

Dubai Silicon Oasis Auditors

1 Comments

https://vskamagrav.com/ - kamagra 100 without prescription

ReplyDelete